Tether uses Bitcoin to strengthen its reserves

In a bold move that marks a significant strategy shift, Tether International Limited, the organization behind the pioneer and most popular stablecoin, has declared its new investment plan.

The strategy entails strengthening its reserves portfolio through periodic Bitcoin (BTC) purchases, using up to 15% of its net realized operating profits, according to the company’s recent announcement. The company’s recent endeavors to purchase Bitcoin are part of an initiative aimed at amplifying, diversifying, and fortifying its reserves. By doing so, Tether aims to enhance transparency, providing a more precise portrayal of its financial performance and capital allocation strategy.

The company stated that it would concentrate solely on utilizing profits derived from its investment strategy, bypassing unrealized capital gains triggered by price surges. While other institutional investors usually entrust their Bitcoin custody to third parties, Tether adopts the philosophy “Not your keys, not your Bitcoin.”

The company safeguards the private keys associated with all its Bitcoin holdings, underscoring its commitment to security. As per Tether’s Q1 2023 Assurance Report, as of the end of March 2023, the company already possessed about $1.5 billion in BTC in its reserves. By incorporating Bitcoin into its reserves, the company aims to tap into the digital asset’s growth potential. The company’s decision to allocate a share of its net realized operating profits towards Bitcoin underscores its faith in the cryptocurrency market and its goal to support the broader ecosystem.

Paolo Ardoino, CTO of Tether, affirmed this sentiment, stating, “Our investment in Bitcoin is not only a way to enhance the performance of our portfolio, but it is also a method of aligning ourselves with a transformative technology that has the potential to reshape the way we conduct business and live our lives.”

The company believes that Bitcoin, with its impressive returns over the past decade, has demonstrated its potential as an investment asset. As Bitcoin’s recognition and adoption by major financial institutions grow, Tether sees it as a vital component in diversified investment portfolios.

Tether’s investments also extend beyond Bitcoin. The company disclosed that it is focusing on building communication through peer-to-peer technologies like Holepunch, as well as investing in energy and Bitcoin mining infrastructure, among other ventures with its capital.

As it explores these innovative opportunities in the ever-evolving digital asset landscape, Tether remains committed to maintaining the stability of its flagship stablecoin, Tether (USD₮). The company also emphasized its adherence to rigorous risk management practices to guarantee the stability and security of its operations.

The company’s investment in Bitcoin not only fortifies its financial reserves but also consolidates its position as a trusted, reliable financial infrastructure provider in the digital asset space.

Tether is a pioneer in stablecoin technology, driven by the goal of revolutionizing the global financial landscape. With a mission to provide accessible, secure, and efficient financial, communication, and energy infrastructure. Tether enables greater financial inclusion and media resilience, drives economic growth, and empowers individuals and businesses.

The most transparent, and liquid stablecoin creator in the industry, Tether is dedicated to building resilient and sustainable infrastructure for the benefit of underserved communities. By leveraging advanced blockchain and peer-to-peer technology, it is committed to bridging the gap between traditional financial systems and the potential of decentralized finance.

While Tether’s mission has always been rooted in these values, the way it is expressed through Tether’s products, goals, and initiatives has evolved significantly over the past few years. Tether recently announced an investment in the development of new energy sources in Uruguay to power renewable Bitcoin mining.

In July 2022, Tether announced the co-founding of Holepunch, a purely P2P platform for building unstoppable, encrypted applications, the first being Keet, a P2P communication protocol.

Tether has always worked closely with the governments of El Salvador and Lugano to help develop each country into the financial hub of their region in the digital age.

All of these initiatives come together to create a company with a mission to grow and thrive. Thanks to its record profits, Tether is well-positioned to expand its mission of improving the world’s financial, economic, media, and energy infrastructure, especially in emerging markets.

Bitcoin Mining in Uruguay

On the surface, many people may not understand why Bitcoin mining is beneficial for Uruguay, which requires understanding the impact Bitcoin mining has on the network and local communities.

Tether is investing, not only in Bitcoin mining but also in the development of new energy infrastructure that does not currently exist. This expands the ability to provide energy in an area with limited energy resources. Why do you need Bitcoin mining to do this, can’t Tether build an energy infrastructure without using it to mine Bitcoins?

Bitcoin mining is necessary because, in areas with low energy resources, the demand for energy is also lacking (because it is not available). If all Tether did was build energy infrastructure, no one would use or buy fuel. Bitcoin mining provides an immediate, profitable consumer of energy that can be deployed anywhere in the world. Bitcoin mining keeps these projects running and ensures a reliable energy supply that other entrepreneurs can count on as they build other ways to use that energy in the region. It is important to understand that Tether Energy’s operations will always prioritize everyone’s electricity usage, with a focus on using the surplus.

Bitcoin mining first enters a new area and economic development will follow it. However, the benefits for Uruguay don’t stop there.

Both the energy infrastructure and the mining facilities will bring jobs to the region and benefit the communities there. These facilities also have a low footprint and have a very limited impact on the environment, which is not the case with so many other developments.

Bitcoin mining not only helps build the power grid, but it can also help stabilize the grid. As the amount of renewable energy increases, energy availability becomes more variable, which is a difficult challenge to navigate.

How do developed countries address this challenge?

Typically with plants with an excess of natural gas. However, if a country does not have a surplus of natural gas or natural gas turbines, it cannot do this. Bitcoin addresses this challenge in many ways because miners can quickly turn it on or off to minimize the change in renewables. As Uruguay is a leader in renewable energy, with 94% of its electricity generation coming from solar and wind, Bitcoin mining would be a huge benefit to the grid and help prove a model. develop better.

Tether co-founded Holepunch and Keet in 2022 as a way to support free and global communication channels. Tether sees this as a critical pillar of Tether’s mission to provide the world with an accessible, secure, and efficient communication infrastructure. Being able to communicate is the first step to trade and economic development.

Holepunch allows building applications without using any servers. This eliminates the legal risks that countless communication applications are constantly exposed to. Holepunch cannot leak or lose or provide user data, because Holepunch does not have it.

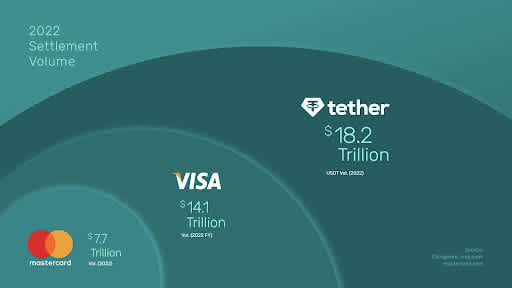

Tether USD₮ recently exceeded its all-time high market cap and is the only primary stablecoin to do so by a large margin. Tether’s competitors are all significantly down from their ATH market capitalization.

This is only possible thanks to our users’ continued support for Tether, which can only be earned through a risk management approach that has kept Tether away from the challenges many have faced. competitors have to face. This has resulted in Tether making a net profit in Q1, exceeding many S&P 500 companies and financial firms like Blackrock.

These profits help strengthen Tether’s reserves and ultimately benefit USD₮ users.

Tether’s Mission

As Tether uses its proven track record to expand beyond stablecoins, it will continue to build, invest, and expand its energy and communications infrastructure. Tether views these domains as essential to its overall mission and supports the use of USD₮ and Bitcoin.

We are excited for this next chapter as the world continues to wake up to the power and benefits of open-source software, P2P communication, and unstoppable money.