Azuki DAO, an informal decentralized autonomous organization around a decentralized collection of information tokens, recently announced a name change to “Bean” after withdrawing from litigation against Zagabond.

The Azuki development team announced that the DAO will transform into a memecoin project and integrate into the Ethereum layer-2 Blast ecosystem, securing $10 million from “famous investors” for development and expansion in Blast ecosystem.

Memecoin Bean is expected to have a total of 1 billion tokens. 40% will be distributed to funding, 50% to Azuki DAO members and 10% to Azuki NFT founder Zagabond, applicable to Azuki NFT holders and must be done within 24 hours of when tokens are issued.

Azuki NFT includes 10,000 avatars (PFPs) with an anime theme. In June, Zagabond issued a second series of 10,000 PFPs, called “Elementals”. Users noticed great similarities between Elemental PFPs and Azuki PFPs, leading to the dilution of Azuki through increased supply.

The price of Azuki NFTs dropped 44% shortly after Elementals launched, suggesting community litigation initiated by Azuki DAO against Zagabond.

Blast

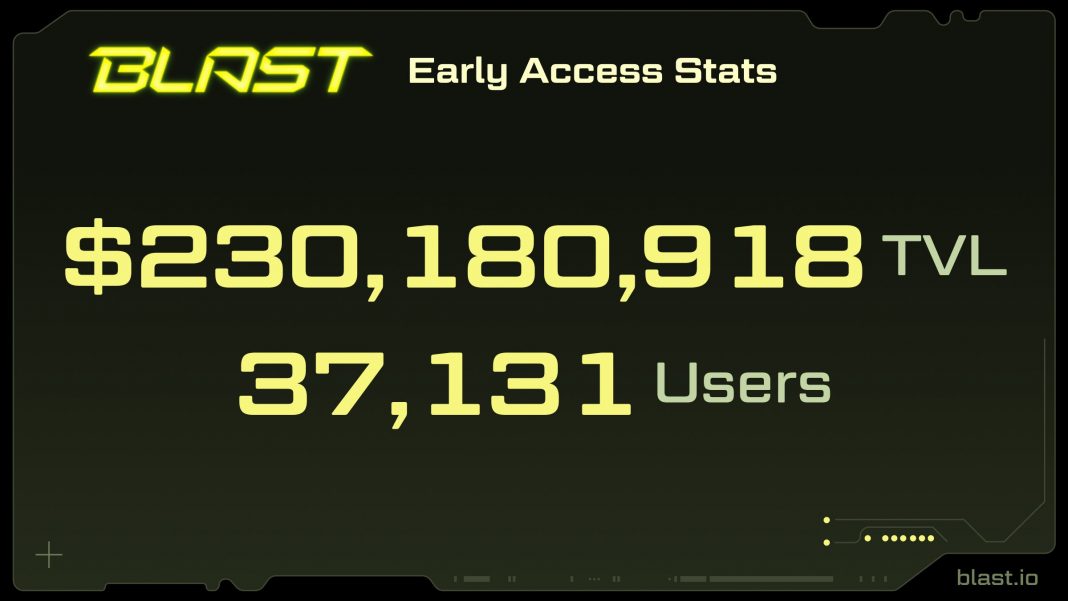

Launched on November 21, Blast after about 3 days has attracted more than 360 million USD in cash flow, of which 313 million USD ETH has been deposited for staking on Lido, becoming the 3rd largest ETH staking holder in the market; 49 million USD DAI sent to Maker DAO; The remaining $635,000 is in the protocol’s multi-sign wallet, according to DeBank data.

Blast was founded by NFT exchange founder Blur Pacman and a number of employees who are former MakerDAO employees, MIT and Seoul University graduates. On November 21, layer-2 on Ethereum announced it had raised $20 million in investment capital from Paradigm, Standard Crypto and eGirl Capital.

Blast is a layer-2 built on Optimistic Rollups technology similar to Arbitrum and Optimism, with EVM so investors and dApps on Ethereum can easily connect. Ethereum offers a base interest rate of 3-4%, Blast’s solution is to use users’ staking money to continue staking elsewhere

Tbh @Blast_L2 is the perfect illustration why non-crypto people hate Web3.

Neither is it a technical advancement to any of the other L2s, nor does it offer any exciting applications to use on top of it.

While disabling withdrawals.

USP: ponzi airdrop farming, again.

— Simon Dedic (@sjdedic) November 23, 2023

Blast’s multi-sig wallet also caused a lot of negativity. Polygon developer Jarrod Watts has claimed that Blast’s five multi-sig wallets are all new addresses and their identities are unknown.

Polygon engineers say that Blast is just a multi-sig contract. To pay users after mainnet, they will need to reach 3/5 consensus, then deploy the money to a new contract.