About Mining

When the ratio of Bitcoin miner earnings to production costs (daily stream) is greater than 1, it indicates that the total miner profit is better than the annual average, marked by the light blue column.

In 2015, after 50 consecutive days of light blue columns, BTC reached its first stage top after a deep drop;

In 2019, after 51 consecutive days of light blue columns, BTC reached its first stage top after a deep drop;

In 2023, there have been 35 consecutive days of light blue columns.

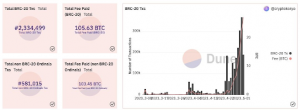

The BTC ecosystem continues to attract attention, let’s take a look at some data:

🌟Overall

TX continues to rise, peaking on May 1 and falling on May 2;

BTC-20 versus the order;

Fees over 200 BTC;

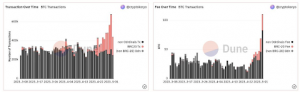

Brc-20

Brc-20 (red) trading is increasing rapidly;

Thanks to the well-spread/imagined name, it quickly surpassed the concept of BTC nft proposed by the ordinances;

Mint

The number of mints is also increasing rapidly;

The wealth creation effect before brc-20 + transaction threshold set by unisat, it can be seen that the minting cost is still increasing.

⚠️Note:

While the concept of brc20 is popular/understood/linked, it won’t really give the BTC defiance that some have falsely advertised and are technically difficult to recognize;

Currently, many memes are being hyped, and practical applications need to continue to observe the ecological development.

Interest rates are the cost of borrowing money, and they can have a significant impact on the economy and financial markets. When interest rates are low, it can encourage borrowing and spending, which can stimulate economic growth. On the other hand, when interest rates are high, it can slow down borrowing and spending, which can cause economic contraction.

Inflation, on the other hand, refers to the increase in the prices of goods and services over time. When inflation is high, it can reduce the purchasing power of money, meaning that people need more money to buy the same amount of goods and services. Inflation can also affect financial markets, as investors may seek to invest in assets that can preserve their value against inflation.

Both interest rates and inflation can affect the demand for Bitcoin. For example, if inflation is high, some investors may view Bitcoin as a store of value, similar to gold, and may invest in Bitcoin to protect against inflation.

Similarly, if interest rates are low, investors may seek higher returns in riskier assets like Bitcoin.

However, it’s important to note that Bitcoin is a highly volatile and speculative asset, and its price can be influenced by a wide range of factors beyond interest rates and inflation. Investors should always conduct their own research and consult with financial professionals before making investment decisions.