RegTech: Definition, Who Uses It and Why, and Example Companies

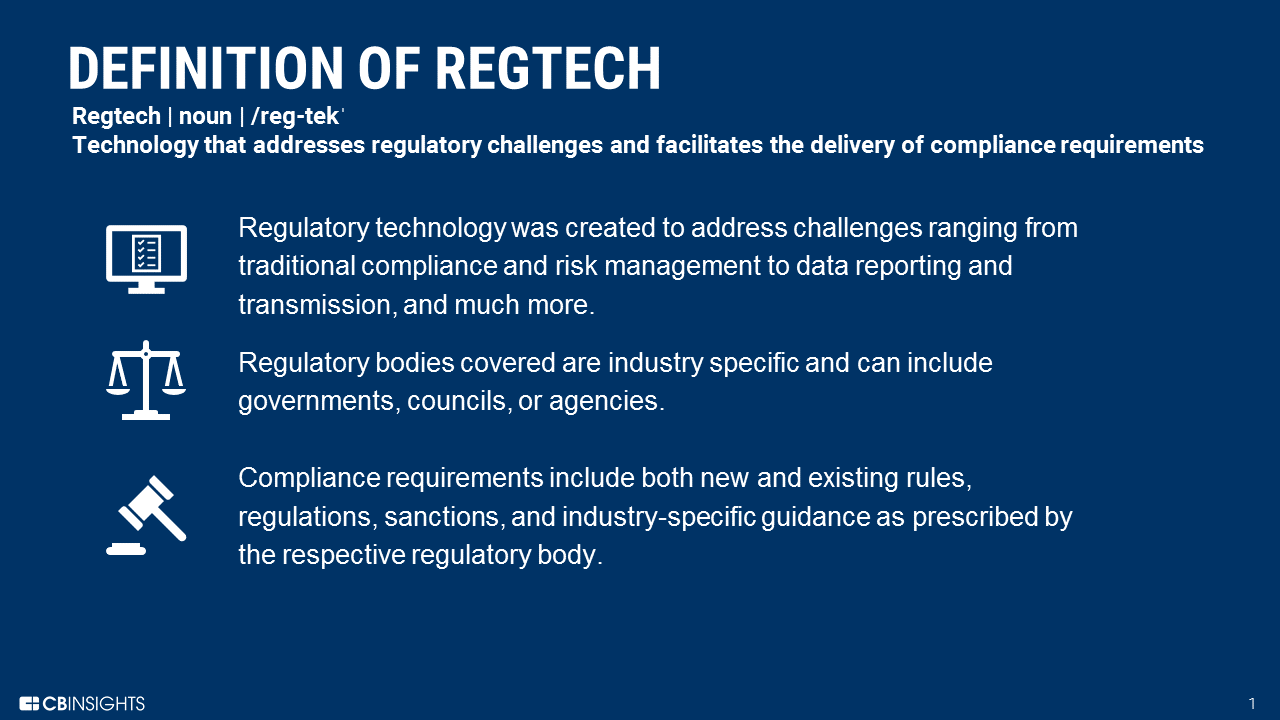

Regtech is the management of regulatory processes within the financial industry through technology. The main functions of Regtech include regulatory monitoring, reporting, and compliance.

Competitive Insight

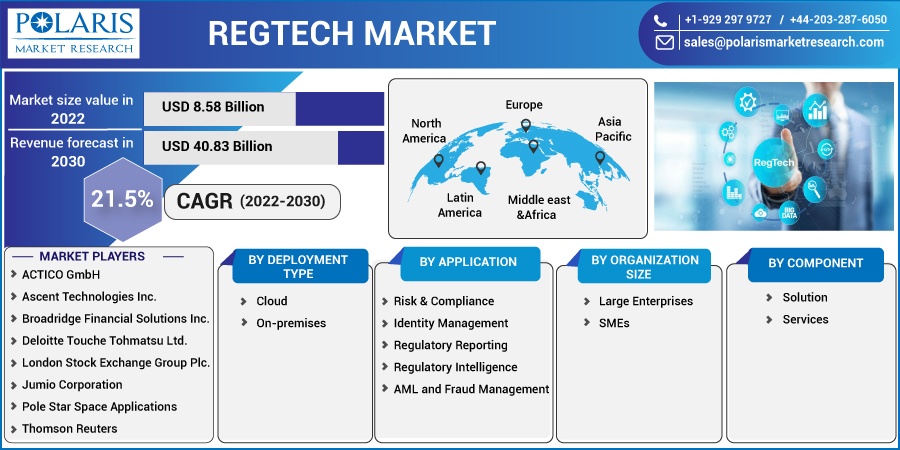

Key players include ACTICO, Ascent Technologies, Broadridge Financial Solutions, Deloitte Touche Tohmatsu, London Stock Exchange, IBM, Jumio Corporation, Pole Star Space, Thomson Reuters, REGnosys, MindBridge, Coryltics, Ayasdi AI LLC., and Chainalysis.

Recent Developments

In December 2021, MetricStream partnered with HCL Technologies. With this agreement, they will provide a highly improved IT and Cyber Risk Management solution to mid-sized enterprises and corporates, allowing them to make smarter & quicker decisions, remove IT threats, and quantify risks.

In September 2021, Trulioo, a Canada-based ID verification firm, partnered with Neobank Zolve to provide their clients with real-time identity verification solutions and services. Currently, the Trulioo platform offers services of real-time verification to 5 billion consumers and 330 million entities worldwide. Regtech is a community of tech companies that solve challenges arising from a technology-driven economy through automation. The rise in digital products has increased data breaches, cyber hacks, money laundering, and other fraudulent activities.

With the use of big data and machine-learning technology, Regtech reduces the risk to a company’s compliance department by offering data on money laundering activities conducted online—activities that a traditional compliance team may not be privy to due to the increase of underground marketplaces online.

Regtech tools seek to monitor transactions that take place online in real-time to identify issues or irregularities in the digital payment sphere. Any outlier is relayed to the financial institution to analyze and determine if fraudulent activity is taking place. Institutions that identify potential threats to financial security early on are able to minimize the risks and costs associated with lost funds and data breaches.

Regtech, or RegTech, consists of a group of companies that use cloud computing technology through software-as-a-service (SaaS) to help businesses comply with regulations efficiently and less expensively. Regtech is also known as regulatory technology. ( nft game . today )

Regtech companies collaborate with financial institutions and regulatory bodies, using cloud computing and big data to share information. Cloud computing is a low-cost technology wherein users can share data quickly and securely with other entities.

The growth of RegTech sub-topics such as financial crime, cyber security, etc. is largely due to the widespread adoption of cloud computing and API programming interfaces in the financial markets.

Vietnam Blockchain Association (VBA)

That is the share of Mr. Phan Duc Trung – Permanent Vice President of the Vietnam Blockchain Association (VBA), about the development of RegTech technology for the financial market.

Risks and challenges from the development of RegTech technology

RegTech is a concept born after the concept of Fintech. It was first mentioned in March 2015, in a Fintech Vision 2025 report for the UK government, under the title “FinTech Futures: The UK as a World Leader in Financial Technologies”. This report is written by Mark Jeremy Walport, Chief Scientific Adviser to the UK Government for the 2013-2017 term. He mentioned a new regulatory technology called regulatory technologies for short RegTech which he believes is the “future of regulation”.

VBA promotes enterprise blockchain application support

On the afternoon of May 17, 2023, the Vietnam Blockchain Association (VBA) celebrated its 1 year anniversary, with the first steps to build the position of an organization that connects and shares values. on blockchain technology; brings together organizations and individuals who are passionate about researching and applying blockchain technology in Vietnam. Mr. Phan Duc Trung – Standing Vice President of VBA announced 4 key programs for 2023 including: Vietnam Blockchain Association Standards; Regtech application; Fundraising support and Textbooks. In particular, the development of the Vietnam Blockchain Association Standard for the blockchain industry, the Chaintracer Anti-Phishing project, and the SwitchUp Business Support Program are particularly focused.

In November 2015, the Financial Conduct Authority in the UK, the FCA (Financial Conduct Authority) officially issued a call to elaborate on FCA issues of interest to RegTech in a report called “Call for Input”. : Supporting the development and adoption of RegTech”.

The rapid growth of RegTech sub-topics such as compliance, financial crime, cybersecurity, and regulatory reporting is largely due to the widespread adoption of cloud computing, Trung said. and application programming interfaces (APIs) in the financial services marketplace.

Platform technologies like this, have provided the corridors in which the RegTech field has evolved. In particular, the newly revised legal regulations took place after the global financial crisis of 2008-2009 and there are many changes required for financial service providers. This also coincides with regulators and watchdogs adopting new technological tools themselves, to strengthen their surveillance capabilities.

A bank

A bank that receives huge amounts of data may find it too complex, expensive, and time-consuming to comb through. A Regtech firm can combine complex information from a bank with data from previous regulatory failures to predict potential risk areas that the bank should focus on. By creating the analytics tools needed for these banks to successfully comply with the regulatory body, the Regtech firm saves the bank time and money. The bank also has an effective tool to comply with rules set out by financial authorities.

Following the 2008 financial crisis ushered in an increase in financial sector regulation. There was also a rise in the disruptive use of technology within the financial sector. Technology breakthroughs led to an increase in the number of fintech companies that create technology-driven products to enhance the customer experience and engagement with financial institutions. ( nft game . today )

The reliance on consumer data to produce digital products has led to concerns among regulatory bodies calling for more laws on data privacy usage and distribution. The coupling of more regulatory measures and laws with a sector more reliant on technology brought about the need for regulatory technology.

As of mid-2018, deregulation in the United States—as seen in the unwinding of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) rules—has led to a slowdown in Regtech company financing deals, though the compliance burden should still fuel the drive toward greater automation.

Characteristics of RegTech

Some of the important characteristics of Regtech include agility, speed, integration, and analytics. ( nft game . today )

Regtech can quickly separate and organize cluttered and intertwined data sets through extract and transfer load technologies. Regtech can also be used to generate reports quickly. It can also be used for integration purposes to get solutions running in a short amount of time. Finally, Regtech uses analytic tools to mine big data sets and use them for different purposes.

- source: https://www.cbinsights.com/

RegTech Applications

Regtech operates in various spheres of the financial and regulatory space. A number of projects that Regtech automates include employee surveillance, compliance data management, fraud prevention, and audit trail capabilities.

– source: https://www.desfran.com/

– source: https://www.desfran.com/

A Regtech business can’t just collaborate with any financial institution or regulatory authority as it may have different goals and strategies that differ from the other parties. For example, a Regtech that seeks to identify credit card fraud in the digital payments ecosystem may not develop a relationship with an investment firm concerned with its employees’ activities online or the Securities and Exchange Commission (SEC) whose current issue may be an increase in insider trading activities.

Why is RegTech important?�

Needless to say, Covid-19 has led to a significant increase in financial crimes. While financial institutions’ (FI) goal is to ensure business continuity and adapt to the change in operations, they also need to focus on tackling the emerging threats from financial crimes, such as ML, TF, frauds, etc. The pandemic creates more challenges for the FIs regarding how they conduct their risk management and compliance function.

An example of a challenge would be, companies facing the issue of conducting anti-money laundering (AML) and know-your-customer (KYC) due to remote work arrangements and a possible change in approval protocol. However, with eKYC, remote digital onboarding of customers can be conducted. ( nft game . today )

Therefore, FIs need to embrace these RegTech solutions to curb crimes.�

How RegTech helps organizations achieve global regulation and compliance?

To achieve global regulations and compliance, organizations need to adopt the cutting-edge technology RegTech solution. These digital solutions leverage data and knowledge from the experts – compliance officers – allow businesses to detect suspicious activities more accurately, efficiently, and quickly.

As a result, embracing these RegTech solutions help curb financial crimes. Moreover, with the digitization of RegTech, these solutions are becoming more cost-effective, scalable, and long-term to accomplish compliance.

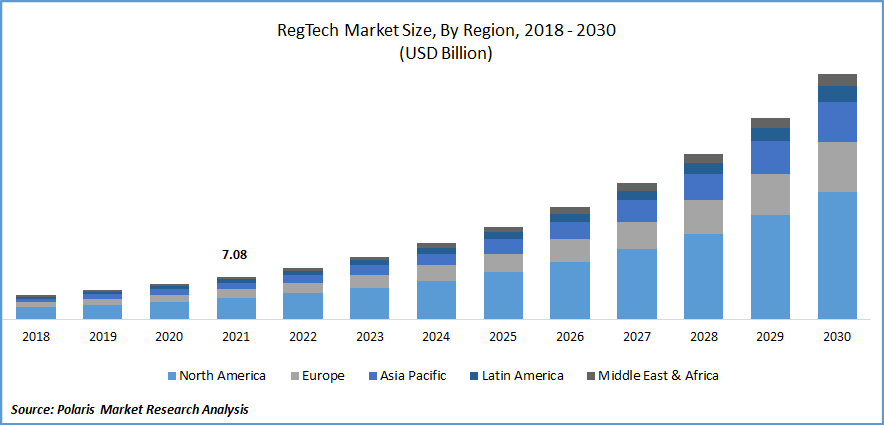

Source: RegTech Market Share, Size, Trends, Industry Analysis Report, By Deployment Type (Cloud and On-premises); By Application; By Organization Size; By Component; By Region; Segment Forecast, 2022 – 2030

How is Regtank contributing to RegTech and Why is RegTech important to us

At Regtank, we recognize the necessity of adhering to regulatory compliance responsibilities, as the cost of non-compliance would be higher. As a result, we seek to assist organizations in achieving regulatory compliance with our powerful one-stop compliance solution, which provides a 360° risk profile by utilizing our unique smart risk assessment engine.